If you would like to begin buying and selling shares, there is no scarcity of various apps to select from. In distinction to conventional buying and selling platforms, they’re sometimes free to make use of and will let you make investments with very small quantities. They’re additionally designed to be straightforward to make use of for novices.

Robinhood and Webull are two of the most well-liked choices. Robinhood is the higher recognized of the 2, however Webull presents lots of the identical options. So how do they examine, and which one is best for you?

What Is Robinhood?

Robinhood is arguably the best-known buying and selling app. It was launched in 2013 and right now has over 20 million customers. Anybody can enroll, and you should purchase fractional shares, which is right if you would like to begin buying and selling with out risking a big quantity. Robinhood means that you can purchase shares, choices, and cryptocurrencies, and it does so with out charging a fee.

Obtain: Robinhood for Android | iOS (Free)

What Is Webull?

Webull launched in 2018, providing lots of the identical options of Robinhood. It is not fairly as standard, however that is partially as a result of it hasn’t been round as lengthy. It presents an analogous number of belongings to spend money on, and, like Robinhood, it goals to construct a userbase by providing free buying and selling with no minimal deposit. Webull is primarily used on smartphones, nevertheless it additionally has a desktop app.

Obtain: WeBull for Android | iOS (Free)

Robinhood vs. Webull: How Do They Examine?

Robinhood and Webull are extremely comparable and have many an identical options. There are, nonetheless, just a few necessary variations.

Out there Property

Robinhood and Webull each will let you commerce shares, ETFs, and choices. Each apps will let you spend money on cryptocurrencies, however Webull is arguably higher suited to this function because it has extra cash accessible.

Charges

Robinhood and Webull each provide commission-free buying and selling. There is not any minimal deposit, you do not pay a charge on particular person trades, and there is no necessary month-to-month cost. It is free to withdraw money from both platform however they each cost $75 to switch an asset, reminiscent of a inventory, out of your account.

Margin

Each buying and selling apps will let you commerce on margin. Which means that they lend you cash to take a position, and in case your commerce is profitable, you may make considerably extra. It is necessary to notice that margin buying and selling is taken into account a high-risk exercise as a result of it additionally means that you can lose your cash considerably quicker, multiplying your losses!

Robinhood prices $5 per 30 days for entry to margin buying and selling, whereas Webull offers the service without spending a dime. Robinhood prices 2.5% on any cash you borrow, whereas Webull prices 6.99% on the primary $25,000.

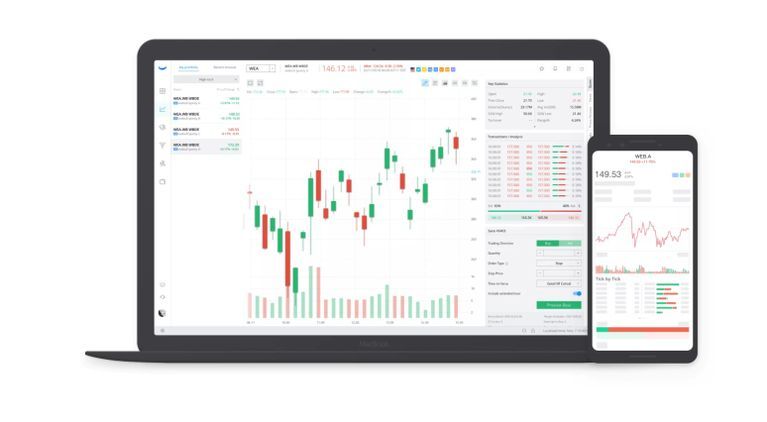

Apps

Each platforms are arguably finest recognized for his or her cell apps. They’re each straightforward to make use of, extremely rated, and do not require prior buying and selling expertise. Each apps, nonetheless, take a barely completely different strategy.

Robinhood goals to make buying and selling as simple as doable. It has a really minimal interface and avoids any pointless data that novices could not perceive. The app consists of entry to charts, however they’re simplified and aimed toward novices. This enables anybody to purchase a inventory with no extra information than the inventory they need to purchase.

Webull is not troublesome to make use of, nevertheless it takes a way more information-heavy strategy. It offers entry to extra informative charts. They embrace the flexibility to see further indicators, view index overlays, and up to date purchase and promote costs. This makes it extra appropriate for novices who need to find out about buying and selling and perceive why shares have explicit costs. Nevertheless, this added data could be overwhelming for first-time merchants.

Webull additionally presents paper buying and selling, which mainly means that you can make digital investments with out risking actual cash. You’ll be able to then hold observe of how every of those investments performs. Paper buying and selling is usually utilized by novice merchants, however professionals can even use it to experiment with new methods.

Each platforms provide web-based buying and selling, however solely Webull presents a devoted desktop app. This might be an necessary distinction for those who plan on buying and selling primarily in your laptop.

Checking Account

Neither Robinhood nor Webull presents a checking account, however Robinhood does provide an analogous Money Administration characteristic. Money Administration is offered to all clients and consists of the flexibility to deposit your paycheck straight into your account. Any cash deposited however not invested earns 0.3% curiosity. Robinhood additionally permits you to join a debit card which is not an possibility with Webull.

The Money Administration characteristic is especially helpful for those who usually make investments a portion of your paycheck or promote shares in an effort to pay bills. In both situation, the cash is available to you with out a further switch.

Robinhood vs. Webull: Which One Is Proper for You?

Robinhood and Webull are each really useful for buying and selling novices. After all, which funding app is best for you depends upon private preferences.

Robinhood is less complicated to make use of, and its reputation with novices is subsequently straightforward to know. In order for you an app that makes buying and selling as simple as doable, Robinhood is the apparent alternative. The supply of what’s extremely just like a checking account can be an necessary benefit.

Webull offers considerably extra data. This makes it standard with skilled merchants, nevertheless it can be helpful to novices. If you wish to make extra knowledgeable decisions about what shares you can purchase, Webull is arguably superior.

The supply of paper buying and selling on Webull can be an necessary level. It could present a helpful alternative to keep away from dropping cash earlier than you perceive what you’re doing.

Neither App Guarantees Funding Success

Robinhood and Webull are each extremely respected, they usually present comparable performance. After all, there are variations, however whichever funding app you select will present a variety of potential investments that may be accessed utilizing a dependable interface.

What’s arguably extra necessary is your alternative of particular person investments to make. It is necessary to notice that almost all retail traders lose cash in the long term, and it’s best to by no means make investments what you can not afford to lose. Offered you observe this recommendation, each apps are value utilizing.

Learn Subsequent

About The Writer