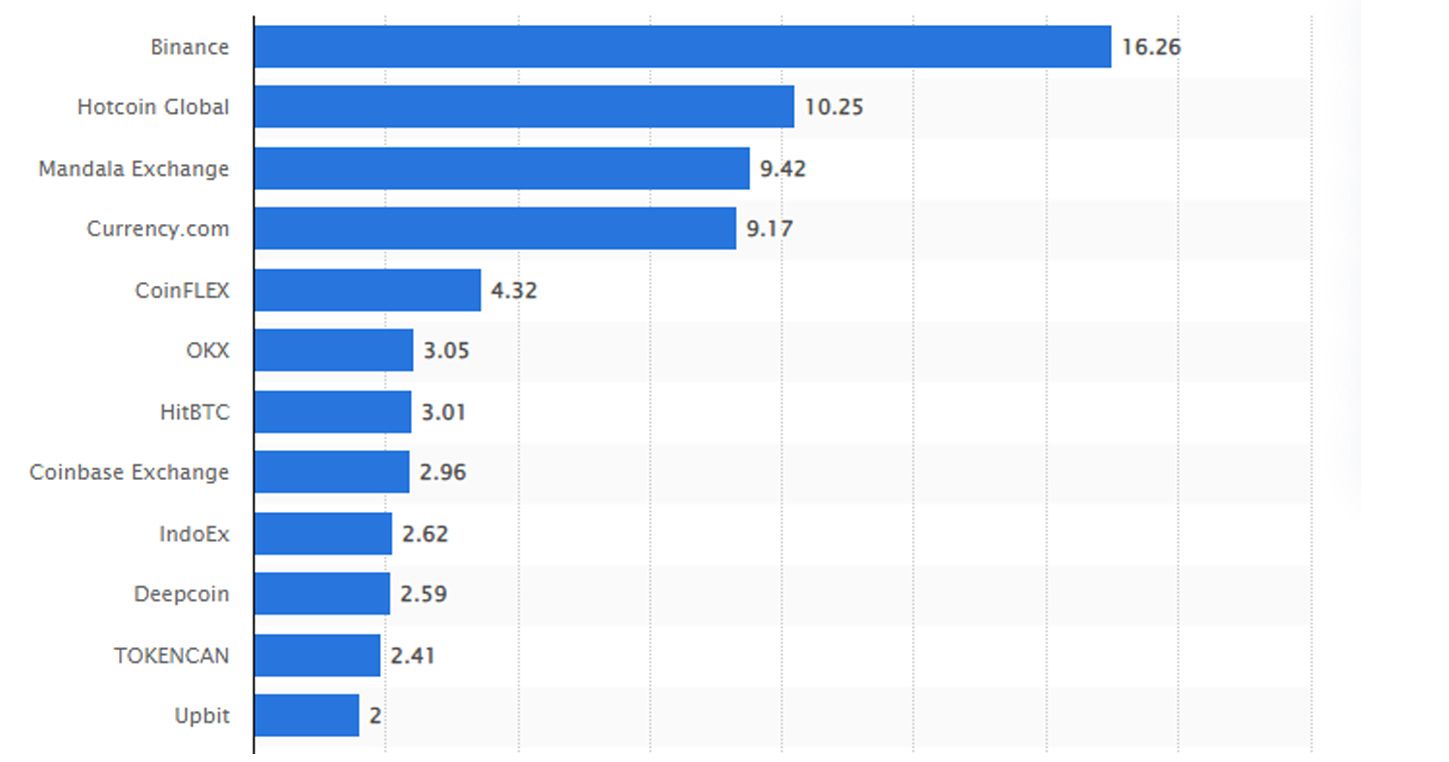

Once you enter the world of cryptocurrencies, you inevitably encounter Binance, the world’s largest crypto trade. Reporting 28.6 million energetic customers by the tip of 2021, Binance is in its personal class by market share, dealing with over 15% of world cryptocurrency visitors. That’s, if we exclude the third-ranked crypto trade, Mandala, with which it shares its liquidity.

To service all these tens of millions of customers, Binance launched Binance Coin (BNB) in the identical yr it was based, 2017. There are various makes use of for Binance Coin, however let’s first begin with how and why it was created.

Why Did Binance Launch Binance Coin (BNB)?

Identical to non-public corporations go public with an IPO (Preliminary Public Providing) to draw traders, cryptocurrency corporations go along with an ICO (Preliminary Coin Providing) to do the identical. With conventional IPO launches, traders achieve a stake in an organization by way of inventory shares. In flip, ICOs launch tokens on blockchain networks.

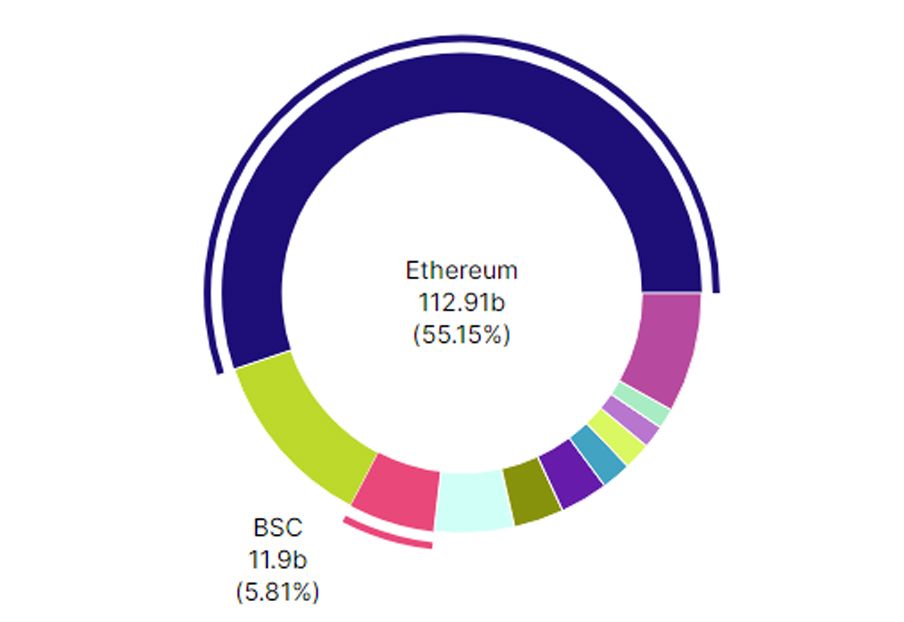

Within the case of Binance, the corporate headed by Changpeng Zhao launched Binance Coin with a ticker BNB on the Ethereum blockchain. Ethereum continues to be the most important good contract platform with 55% of the market share, so it was name to select Ethereum to launch BNB as an ERC-20 token, an Ethereum good contract normal.

Three years after the launch of Binance Coin, Zhao launched Binance Good Chain (BSC). That is Binance’s model of Ethereum. Nonetheless, BSC nonetheless has a 9x decrease market share than Ethereum, at less than 6% in comparison with Ethereum’s 55%.

With the BNB ICO launch, Binance distributed 10% (20 million BNB) of the tokens, at $0.15 every, to so-called angel traders. These are non-public, rich people who present corporations with sufficient seed cash to completely develop their enterprise roadmap. Binance retained 40% (80 million BNB) of tokens for itself, which left 50% of the remaining BNB provide to the general public.

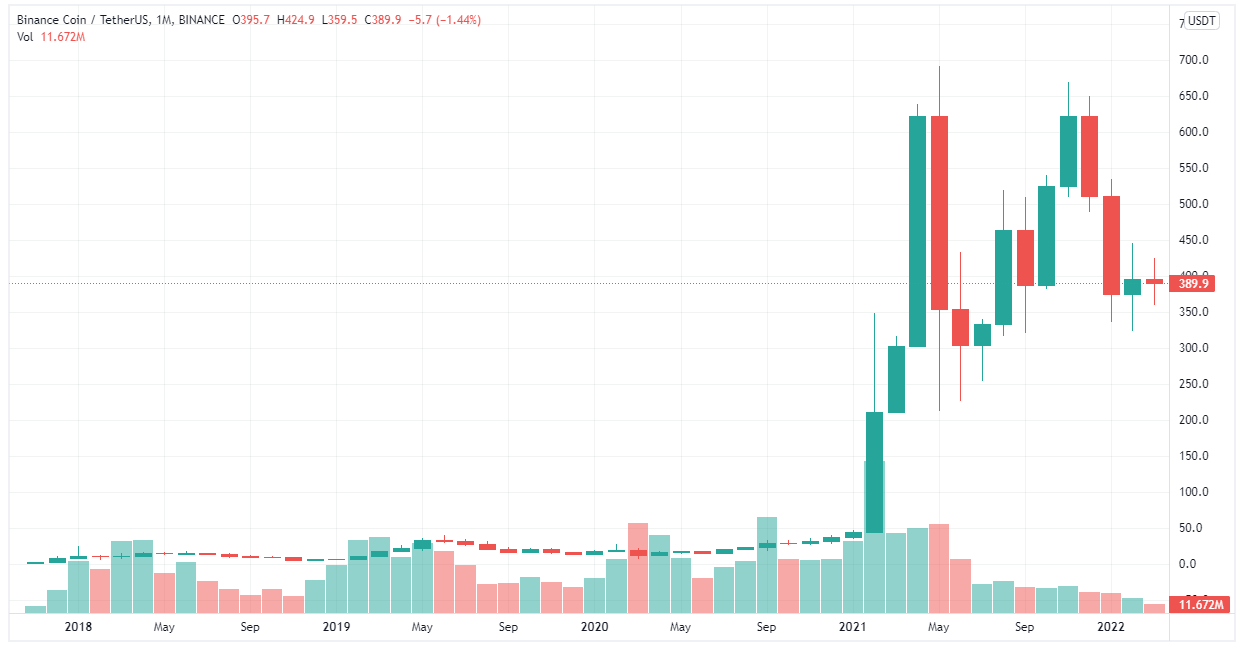

The utmost provide of Binance Coin was set at 165,116,760 BNB. As Binance grew bigger, BNB coin appreciated, similar to the corporate’s shares do within the inventory market. In different phrases, think about getting a maintain of BNB in 2017. It could have appreciated by 368,137 %! Due to this fact, should you had been a Binance investor with only a $1,000 price in BNB, you’d now be capable of flip that one grand into $2.5 million.

Now that you simply perceive the distinction between BSC and BNB, and its service as a funding automobile, it is time to see what you’ll be able to truly do with Binance Coin as a utility token.

Makes use of for Binance Coin Defined

At first, Binance Coin (BNB) represents your stake in Binance itself. When you consider that the corporate is poised to develop even additional, this shall be mirrored within the BNB’s value, permitting you to promote it later for a a lot increased value than whenever you purchased it.

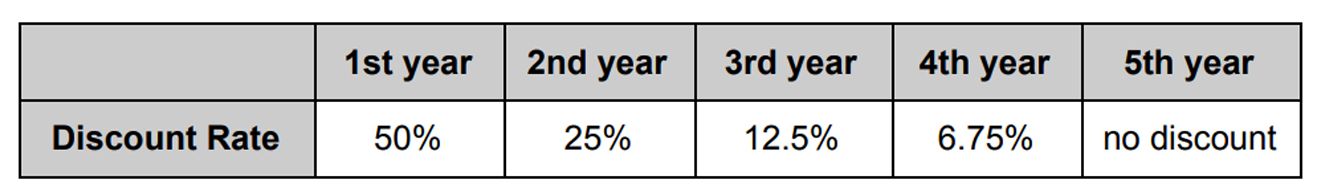

Outdoors of that, BNB is rather like all different cryptocurrencies on different blockchains. You possibly can trade BNB for every other token out there on the Binance trade. Moreover, the corporate incentivizes you to carry BNB as a result of it provides you a reduction whenever you pay your switch/trade charges in BNB as an alternative of different currencies.

Increasing out additional with different exchanges, Binance made a cope with Crypto.com. This trade made a cope with bank card corporations to difficulty bank cards backed up by crypto property. In flip, Binance noticed this as a possibility for Crypto.com to incorporate BNB as a type of cost for bank card payments. This manner, Crypto.com gained inroads to Binance’s bigger person base, whereas Binance gained extra mainstream acceptance of its native cryptocurrency.

Likewise, on-line retailers can choose to decide on BNB to pay for his or her providers. This ranges from reserving lodges and flights to paying for lottery tickets and items. This listing has all online platforms where BNB can be used.

Lastly, Binance has its personal model of PayPal, known as Binance Pay. With BNB in your Binance pockets, customers can use them straight to buy at these merchants, with out having to make any fiat-crypto conversions.

BNB Burning Mechanic

On a ultimate be aware, Binance has a mechanism that ensures BNB will recognize in worth by making them scarce. It does this by quarterly burnings, as defined within the official Binance whitepaper. Burning tokens simply means eradicating them from circulation, so that they kind a extra scarce pool.

“Each quarter, we are going to use 20% of our income to purchase again BNB and destroy them, till we purchase 50% of all of the BNB (100MM) again. All buy-back transactions shall be introduced on the blockchain. We ultimately will destroy 100MM BNB, leaving 100MM BNB remaining.”

In spite of everything, Bitcoin grew to become so precious due to its finite restrict at solely 21 million BTC. By the identical token, when the Federal Reserve elevated the USD cash provide by trillions, it vastly devalued the greenback, inflicting a 40-year-high inflation. It simply goes to indicate that, most of the time, entrusting your cash to corporations is a greater guess than in governments.

Learn Subsequent

About The Writer